Resolve Claims Tracker

From accident to rental car—streamlining auto claims with embedded, human-centered AI.

Demo

Background

While designing a claims flow for a mid-sized insurance company, I interviewed a business analyst to better understand customer pain points and the internal workflow. One insight stood out: a major bottleneck occurs when assessors are delayed in reviewing vehicle damage, which can stall the entire claim. Customers also frequently expressed the desire have access to rental cars right then and there—to able to book a rental car immediately—something that's long been on their "wish list."

This inspired me to explore how embedded AI might streamline the process, offload time-consuming tasks from support teams, and help customers regain control during a difficult, high-stress event like an auto accident. The Resolve Claims Tracker concept emerged from this curiosity. While not built for a specific client, the design reflects a realistic and scalable approach to a problem faced across the insurance industry.

Project overview

Resolve Claims Tracker is a white-label insurance tool that streamlines the first notice of loss (FNOL) experience using embedded AI.

From accident to rental car, it guides users through policy checks, photo uploads, and eligibility messaging—reducing delays without sacrificing clarity or control. Most follow-up is handled via SMS, keeping the experience lightweight, transparent, and user-friendly.

Impact

The Resolve Claims Tracker shows promise for streamlining complex claim processes and improving user experience.

| Stakeholder | How Resolve Claims Tracker Helps |

|---|---|

| Customer |

|

| Customer Support |

|

| Claims Assessors |

|

| Business |

|

Framework

Define the Jobs to be done

AI capability mapping

Integration strategy with existing UX

Flexibility & personas

Artifacts

Detailed use case

User journey

User flow with AI Integration

Prototype

Starting the journey

The customer journey begins after an accident, when the user logs into the Resolve Claims Tracker to start their claim.

This journey map highlights key pain points and shows where AI can step in to support, guide, and accelerate the experience. See Map

Opportunities for AI

Instant policy-based eligibility checks

Photo damage assessment

Rental car recommendation and booking

Real-time claim tracking and messaging

Contextual help

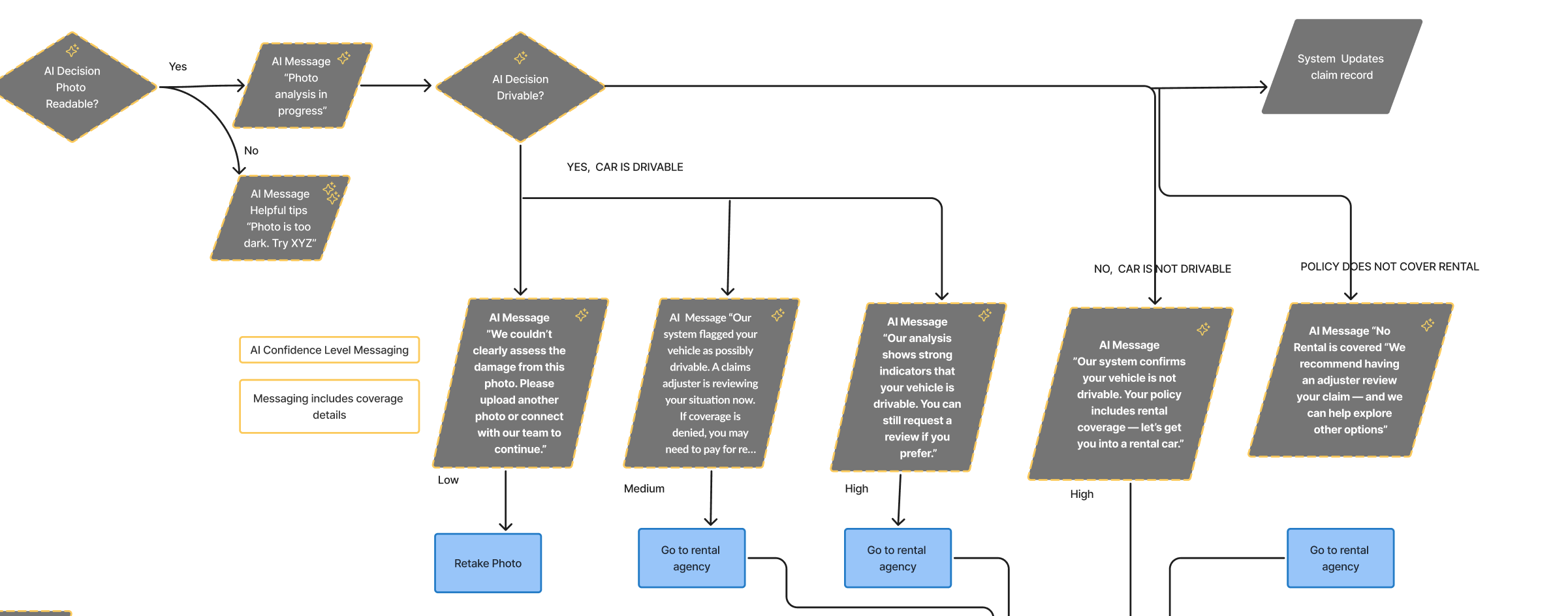

Decision Flow in Action

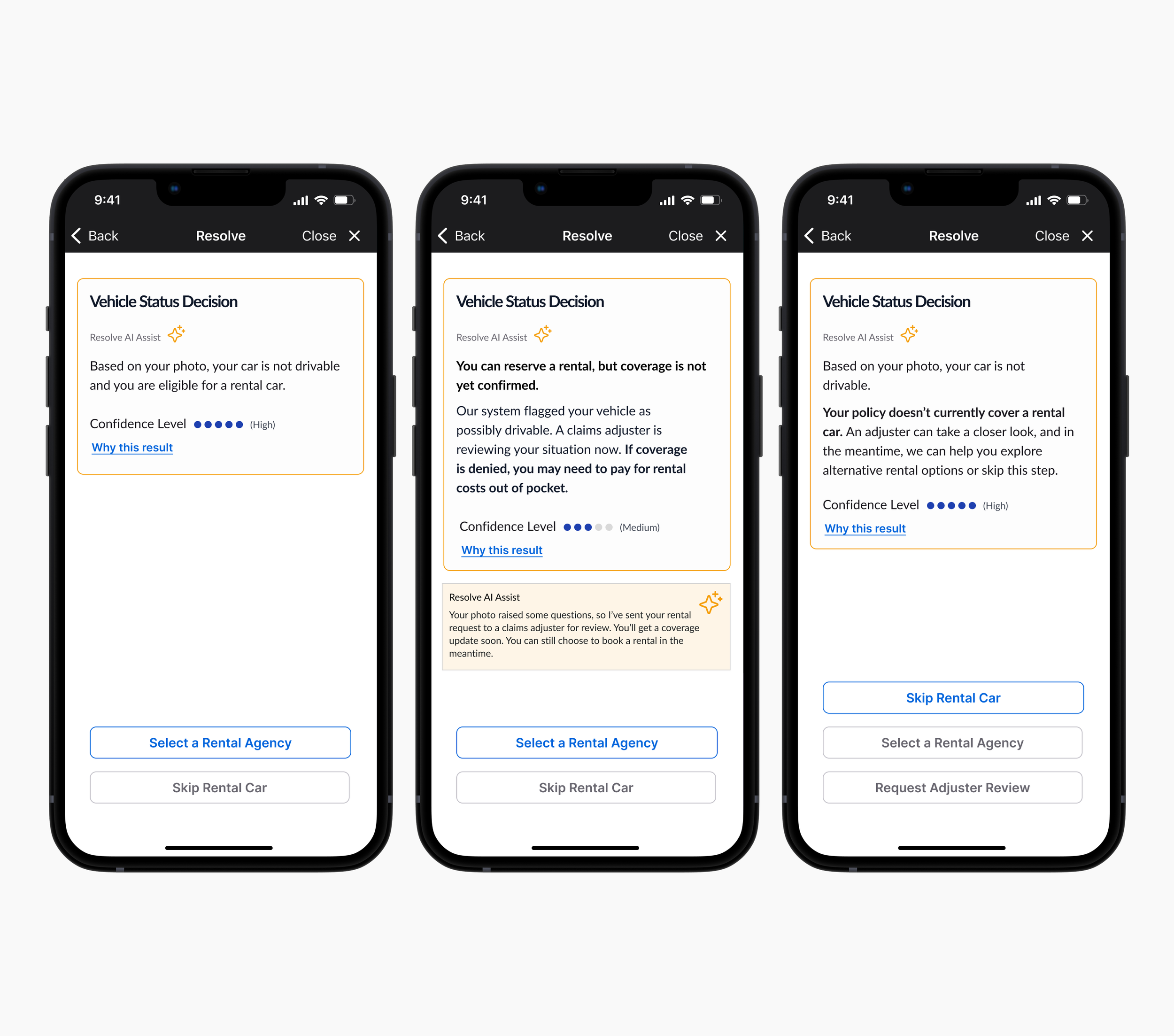

This segment of the Resolve Claims Tracker flow demonstrates how AI is used to evaluate vehicle damage and guide users based on confidence levels. After a user uploads a photo, the system analyzes its visibility and quality.

Depending on the AI's confidence in assessing drivability, tailored messages are delivered—ranging from suggestions to retake the photo, to confidently routing the user toward rental car booking.

The flow also accounts for unclear or low-confidence images, offering alternative actions like submitting more photos, continuing without rental, or contacting support. This logic helps minimize delays while preserving user control and transparency. See Flowchart

Trust

AI decisions must be understandable and traceable, giving users clarity on how vehicle assessments, coverage decisions, and eligibility outcomes are determined.

Design Principles

User Control

Users should have options to override, skip, or ask for help—empowering them to make informed choices that suit their situation.

Usefulness

AI should help users complete key tasks—like uploading photos or booking a rental—by reducing friction and providing clear, efficient guidance.

Human-AI Collaboration

Users should have options to override, skip, or ask for help—empowering them to make informed choices that suit their situation.

Key Screens & UX Patterns

Guided by AI, Grounded in User Needs

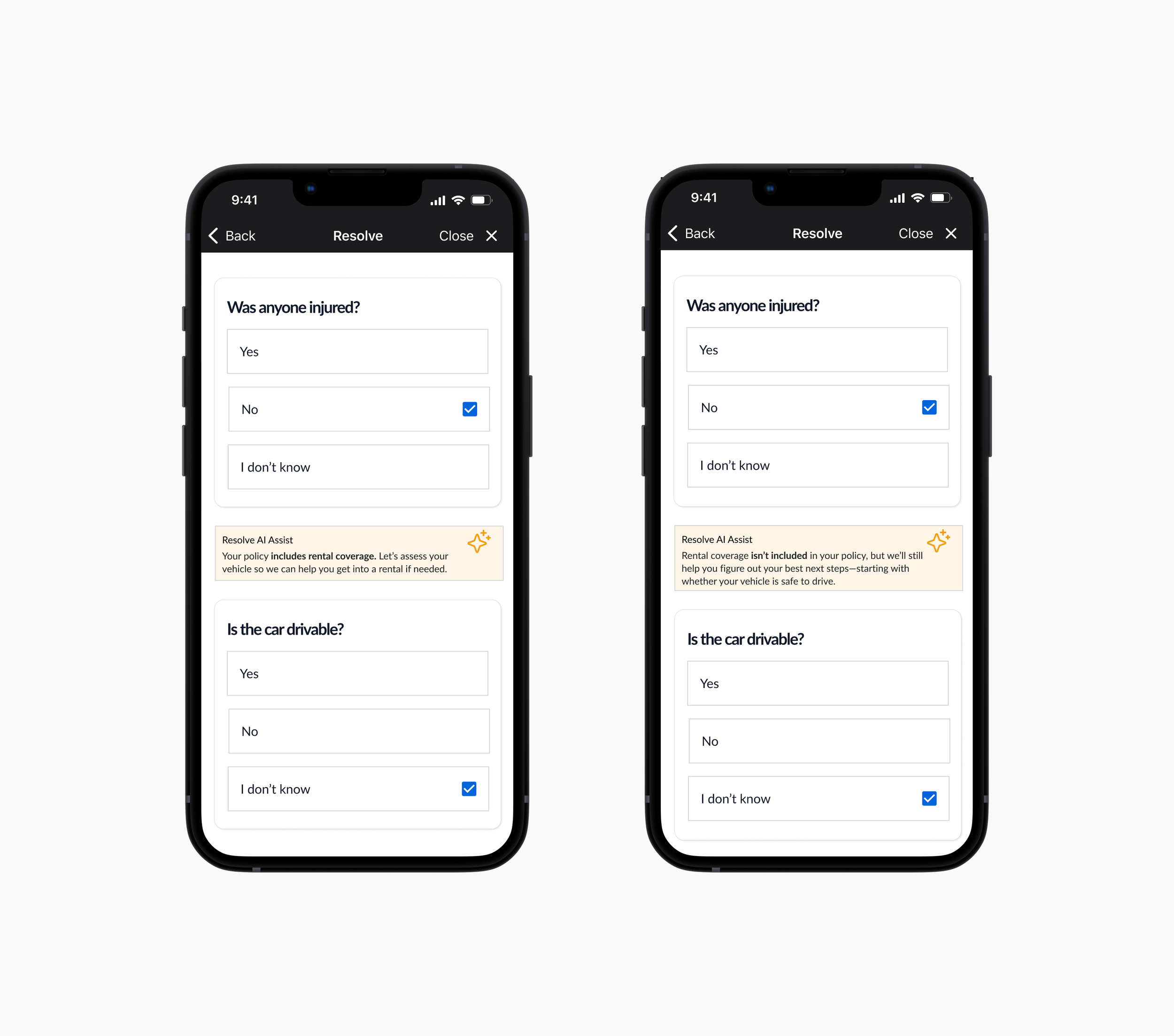

Policy Coverage

Reviews your policy to determine rental car eligibility

Maintains support and next steps, even without coverage

Helps users feel informed and in control from the start

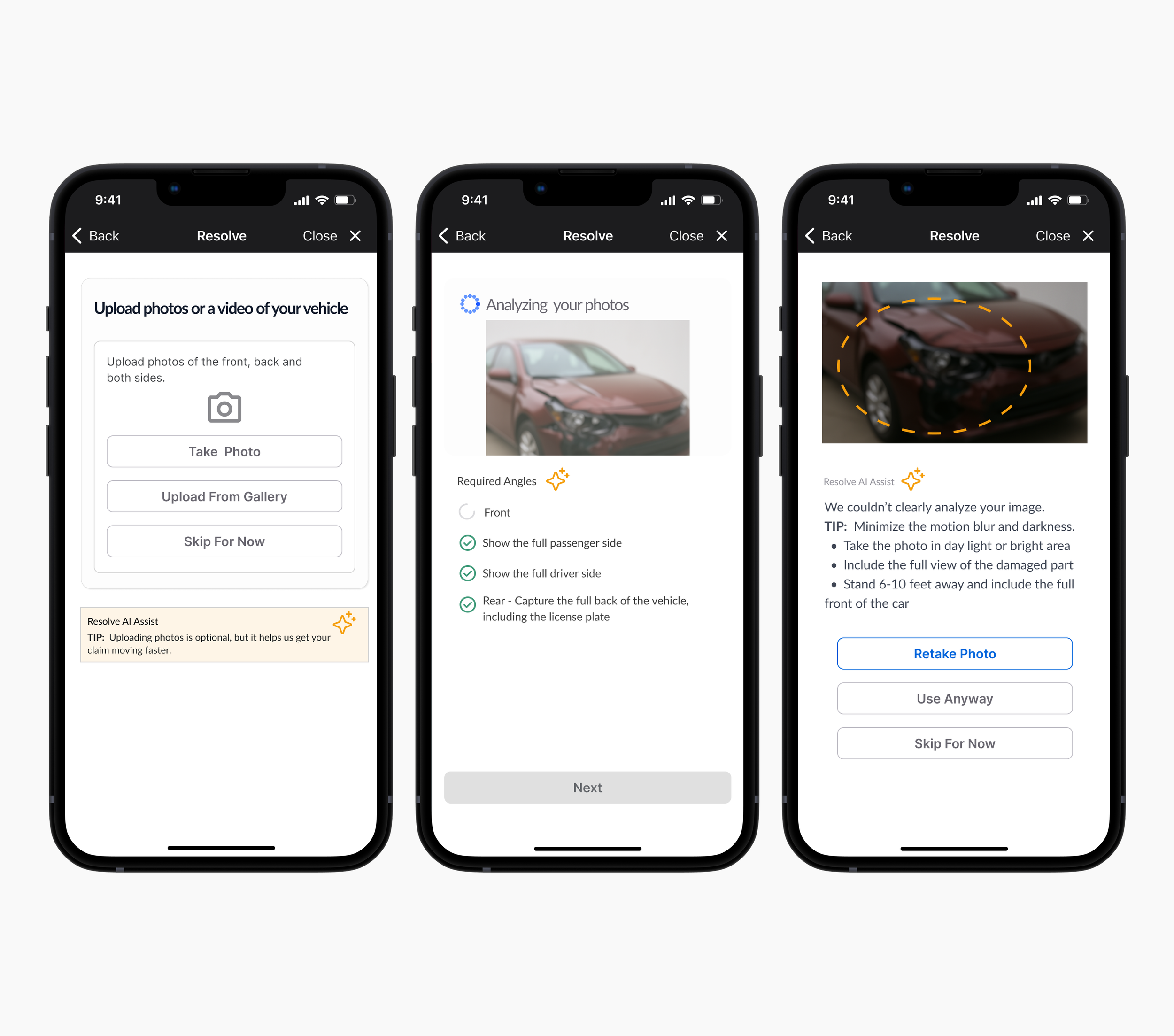

Photo Analysis

Analyzes photos for clarity, angle, and completeness. Speeds up time-sensitive decisions

Speeds up downstream decisions like drivability and rental eligibility

Gives smart, targeted photo-taking tips

Offers user control: retry, override, or skip for manual review

Decision

Interprets image data to assess vehicle drivability

Assigns a confidence level and explains how the result was reached

Adapts messaging based on both policy coverage and damage assessment

Respects user agency with options to skip, self-pay, or request review

Balances automation with human oversight for trust and reassurance

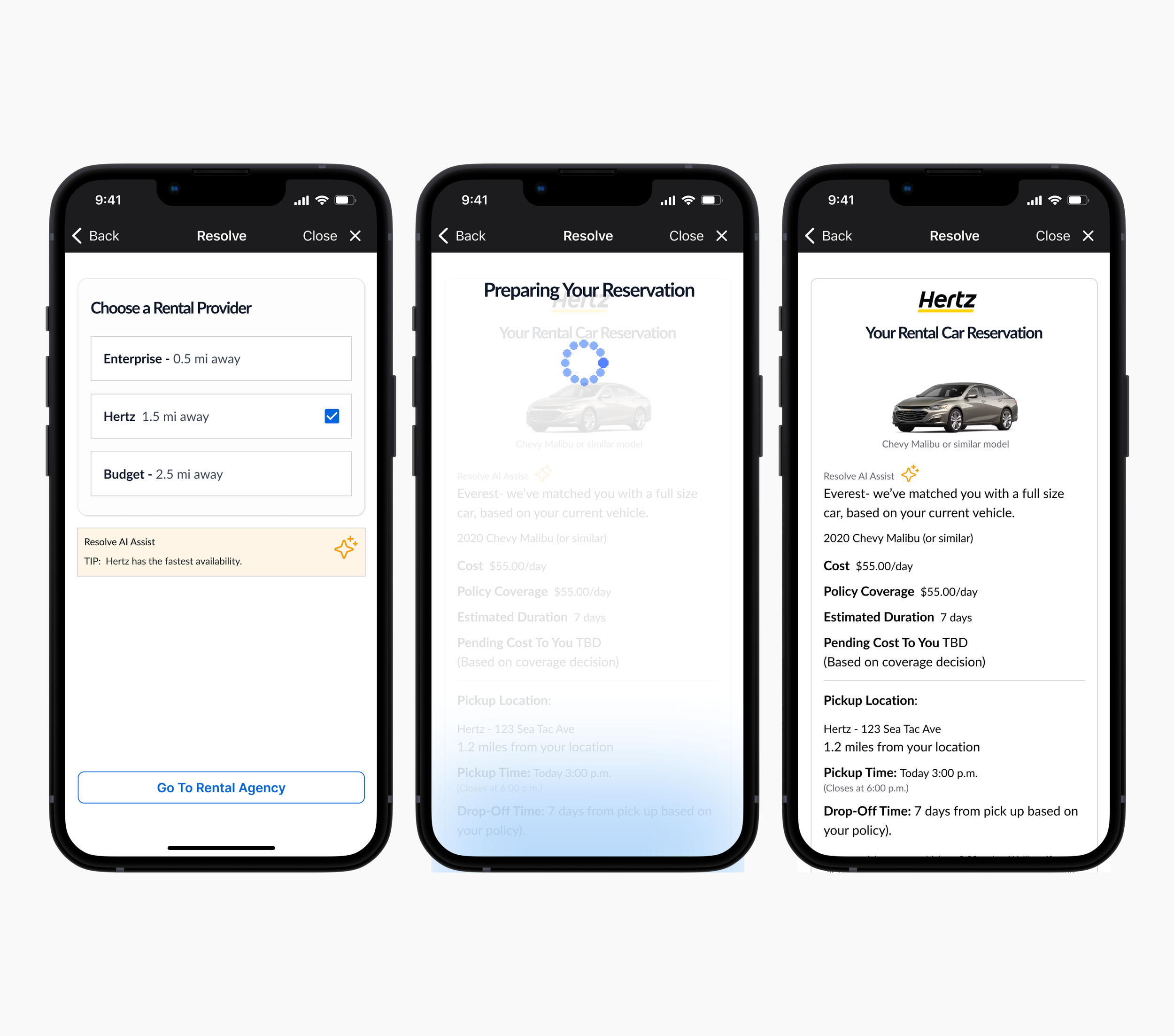

Rental Booking

Recommends rental providers based on real-time availability

Matches user with a vehicle size based on their current car

Builds trust through transparency in cost, location, and next steps

Offers flexible choices

Challenges

Designing with AI required careful attention to trust, control, and clarity. Here are the challenges we faced and how we addressed them through UX.

| Challenge | UX Solution |

|---|---|

| User Distrust in AI Assessments | Displayed confidence levels with rationale and visual cues; users could request adjuster review. |

| Low Confidence in Photo Analysis | Offered photo tips and fallback options; AI explained when it couldn’t assess an image reliably. |

| Uncertainty Around Rental Eligibility | Explained rental eligibility logic clearly; included supportive messaging and help links. |

| Over-Automation Concerns | Let users override, skip, or ask for human support at key points. |

| Transparency in Decision-Making | Included plain-language assistant messages to explain system reasoning. |

| Task Flow Complexity | Used progressive disclosure and guided AI moments to reduce friction and cognitive load. |